sacramento property tax rate

For prior year Unsecured tax bill information please call the Tax Collectors Office between 900 am. Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls.

Sacramento County Transfer Tax Who Pays What

Please make your Property tax payment by the due date as stated on the tax bill.

. Reduce property taxes 4 residential retail businesses - profitable side business hustle. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Business property owners must file a statement each year detailing the cost of all supplies machinery equipment leasehold improvements fixtures and land owned at each location within Sacramento County.

The tax portion of the tax bill remains defaulted and accrues redemption fees and penalties. Automated Secured Property Information Telephone Line. Therefore in order to get an idea of what your property tax will be multiply your estimated property value by 81.

For Secured Tax please contact via telephone at 916 874-6622 or via email at TaxSecuredsaccountygov. 3636 American River Drive Suite 200 Map Sacramento CA 95864. Sacramento County collects relatively high property taxes and is.

View the Boats and Aircraft web pages for more information. 3701 Power Inn Road Suite 3000. Tax Collection Specialists are available for customer assistance via telephone at 916 874-6622 Monday Friday from.

Ad Reduce property taxes for yourself or residential commercial businesses for commissions. 916 875 0700 Phone The Sacramento County Tax Assessors Office is located in Sacramento California. The average effective property tax rate in San Diego County is 073 significantly lower than the national average.

A delinquency penalty will be charged at the close of the delinquency date. View the E-Prop-Tax page for more information. When calling the Tax Collectors Office your call is answered by our.

For payment by phone call 844 430-2823. For comparison the median home value in Sacramento County is 32420000. Property taxes are a vital source of income for West Sacramento and the rest of local public districts.

Get driving directions to this office. Tax bill amounts due dates direct levy information delinquent prior year tax information and printable payment stubs are available on the Internet using your 14-digit parcel number at e-Prop-TaxA property owner may request a copy of the current year secured property tax bill by. Available 24 Hours a day 7 days a week 916 874-6622.

The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate of 068 of property value. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. The Sacramento average property tax rate for 2022 is 81.

With that who pays property taxes at closing while buying a house in Sacramento County. Permits and Taxes facilitates. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail.

Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and bill the tax. All are public governing bodies managed by elected or appointed officers. Property ownership shifts from the seller to the buyer upon closing.

Last day California Law allows the TAX. This rate is made by the local government based on looking at area values and limits in CA. Visit Our Website For Records You Can Trust.

Property tax payments are normally sent off beforehand for the entire year. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. To 400 pm Monday Friday at 916 874-6622.

Tax Collection Specialists are available for customer assistance Monday Friday from 900am to 400pm. Privately and commercially-owned boats and aircraft are also subject to personal property taxes. Get Accurate Sacramento Records.

Property tax specialists are available by phone from 900 am. Box 508 Sacramento CA 95812-0508. For Unsecured Tax please contact via telephone at 916 874.

Ad Find The Sacramento Property Tax Records You Need In Minutes. Our Mission - We provide equitable. In addition to counties and districts like hospitals many special districts such as water and sewer treatment plants as well as parks and recreation facilities are funded with tax capital.

The Sacramento average property tax rate for 2022 is 81. Monday through Friday excluding holidays at 916 874-7833. Choose Avalara sales tax rate tables by state or look up individual rates by address.

If you need to find your propertys most recent tax assessment or the actual. Sacramento California 95826. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate.

When secured property taxes are unpaid on June 30th they become a prior year delinquency and the taxes. However because assessed values rise to the purchase price when a home is sold new homeowners can expect to pay higher rates than that. And so does the liability for remitting real estate.

For paper checks use the mailing address PO. 916-875-0740 or e-m ail.

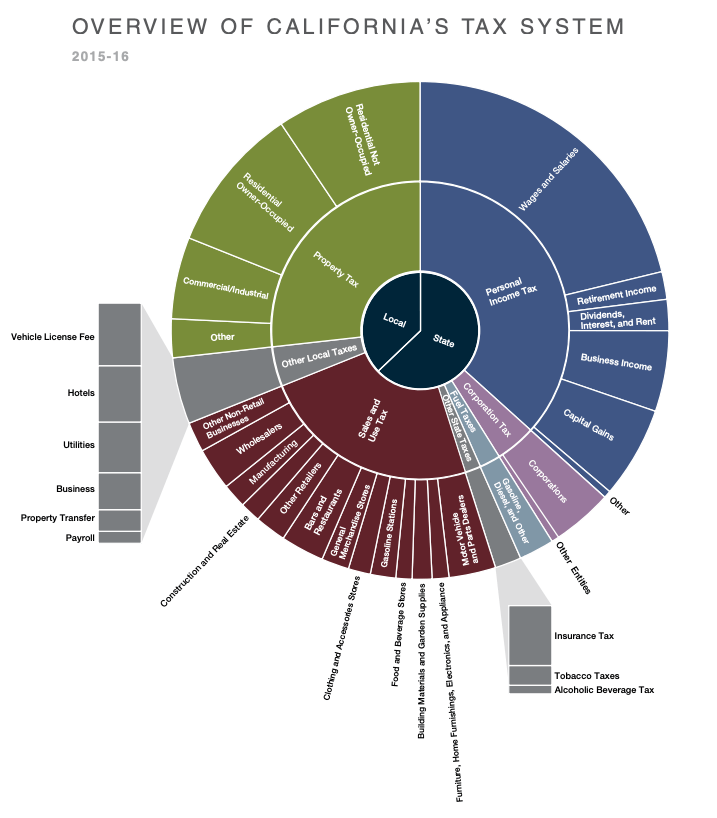

Understanding California S Property Taxes

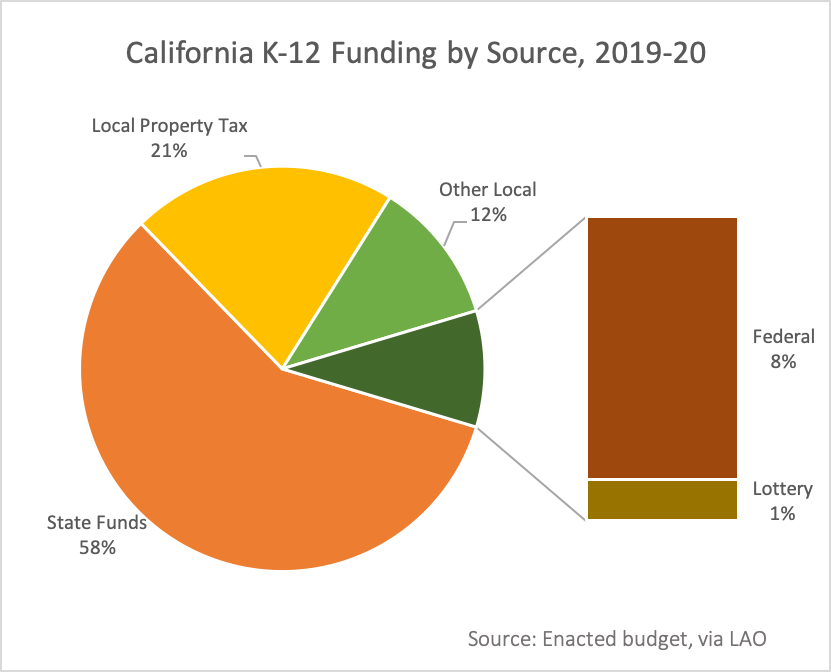

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

Center For Special Taxes Caltax Foundation

Property Taxes By State 2015 Eye On Housing

Welcome To The Thurston County Assessor S Office

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

Understanding California S Property Taxes

2021 22 Sacramento County Property Assessment Roll Tops 199 Billion

Tax Breaks For Small Farms And Agribusiness In California

Letter To The Editor Don T Frame Property Tax Rate In Moral Terms Memphis Local Sports Business Food News Daily Memphian

Tampa Port Votes To Lower Property Tax Rate But Floats Future Increase

Pennsylvania Property Tax H R Block

Understanding California S Property Taxes

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center